- JMP User Community

- :

- Blogs

- :

- JMP Blog

- :

- Retirement income: What you can expect yearly and monthly

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

So you have decided it’s time to retire, and you know how much you have in your retirement nest egg. You been good, and you have saved what you could. But there are two big questions that always come up: Did I save enough? How long will my nest egg last?

This is not the end-all and be-all guide to retirement, but coupled with a post on what to expect from Social Security that I co-wrote with Scott Wise (@scwise), you can get a reasonable idea of what to expect as far as your monthly retirement income is concerned.

There are several options and lots of suggestions on how much you should pull from your retirement accounts to support yourself. The most prevalent suggestion is to pull 4% per year, but is that enough? Or could it be too much depending on your living situation? One other question that you need to answer is what your tax rate will be on money withdrawn from a traditional 401K. If you have a Roth IRA, you will not have as big a tax burden, but there will still be taxes to pay; so please make certain you are up to date on the rules of engagement. These change all the time and could trip you up if you are unaware.

I keep saying "you ” – and although the reality is that retirement is still several years away for us – we wanted to know what we can expect based on what we have right now. We also wanted to know if what we have is enough to keep us comfortable and maintain a standard of living we are used to at this point in our lives.

What I have done is bracket several potential amounts folks may have saved up for retirement. So, between $100,000 and $2,000,000 and eight levels in between. I am mindful that some folks have less than $100,000, and some have way more than $2,000,000. Again, this is just a guidepost. Everyone should take the financial pundits’ suggestion to heart and save for retirement early and often. Having too much money saved for retirement seems impossible to me. The more you have, the better you will live out your “golden” years.

Yearly Income

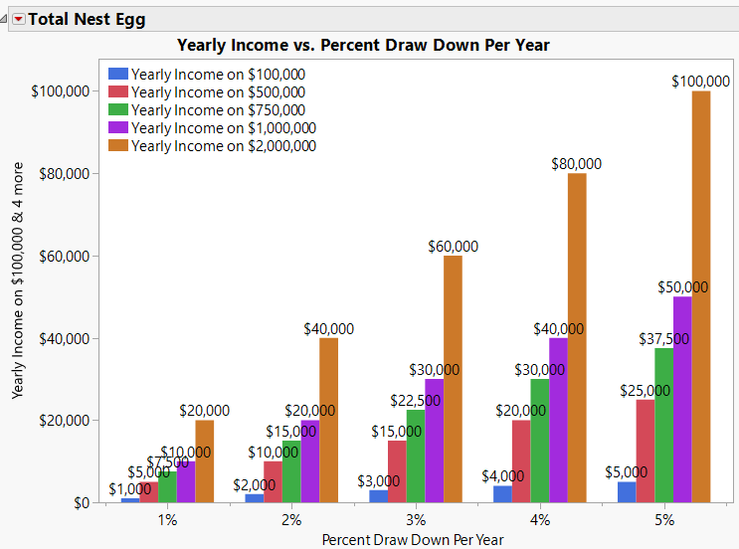

So, let’s look at some of the numbers. In the JMP graph below, you will see a side-by-side comparison of yearly income based on the size of your retirement nest egg and withdrawing at a rate of between 1% and 5%. Remember, the pundits like to say that 4% is the optimal withdrawal rate.

This graph was very enlightening for me at least. If you are lucky enough to have $1,000,000 saved and draw down at 4% annual rate your yearly income will be $40,000. Will that be enough to live on? There are a couple of things to consider here that will add some comfort. You can expect some sort of Social Security income until 2034 (that could change), and you can always take on a side gig to earn extra income. For 2022, you can earn up to $19,560 without impacting your Social Security benefits, and that is only if you haven’t reached full retirement age (FRA). Once you reach FRA, you do not have to worry about income from a job impacting your benefits.

Monthly Income

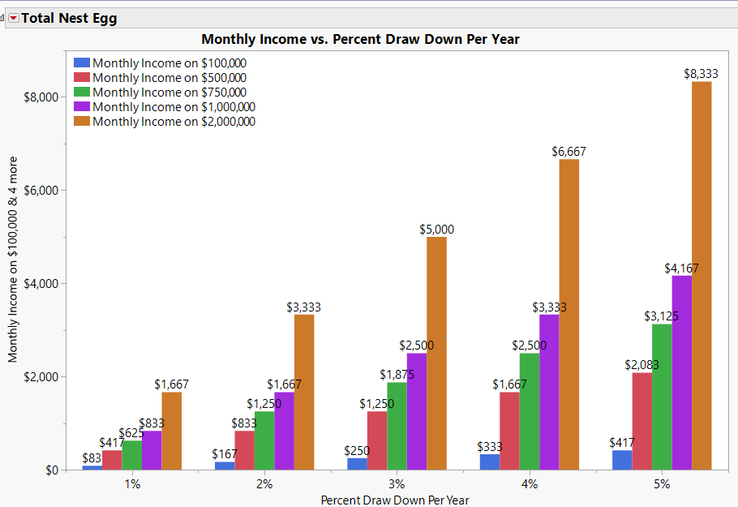

The graph below shows monthly income based on the given 1-5% withdrawal rates. This graph provided a different perspective, and it was another eye-opener to see how much monthly income can be expected compared to what you earned before retirement. You can view both graphs, side by side, at JMP Public.

In the end, it all comes down to what you have and what you need to live a comfortable lifestyle. Please use this blog post as it is intended, which is to educate yourselves on what you have now and what you hope to have in retirement. The formulas used in calculating are very simple and are found under the column headers. So if the numbers I have chosen to show don’t match your current numbers, grab the data table, dive in and make the changes. Happy retirement planning!

Interested in the question of how long a retirement nest egg might last? Read the follow-up post I wrote with @DonMcCormack.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- © 2024 JMP Statistical Discovery LLC. All Rights Reserved.

- Terms of Use

- Privacy Statement

- About JMP

- JMP Software

- JMP User Community

- Contact